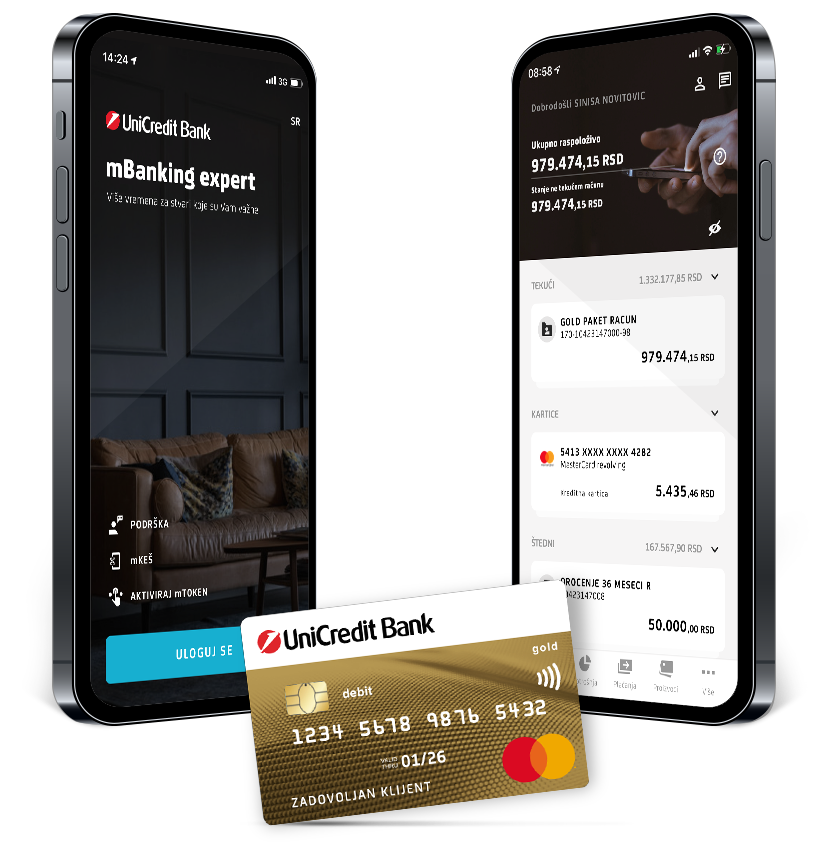

mBanking expert

Do you want to know how much you spend monthly for food, cosmetics, wardrobe? That is easy, in the middle of the day or in the middle of the night our mBanking expert application categorizes all your expenses correctly. All you need to do is to search for transactions by keyword, category, or amount. Your advisor is here to help you to save for some nice trip!

Your finances from a different perspective

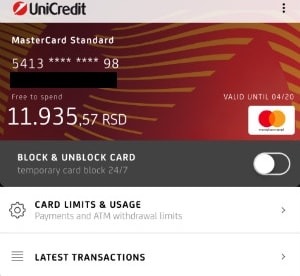

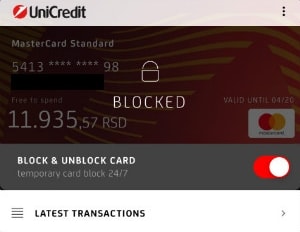

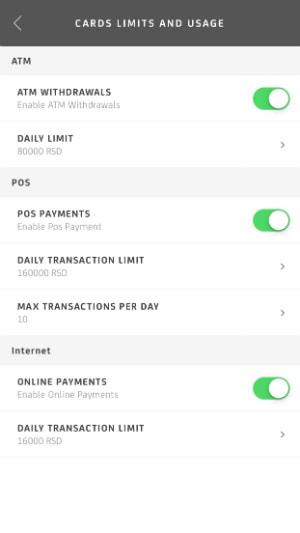

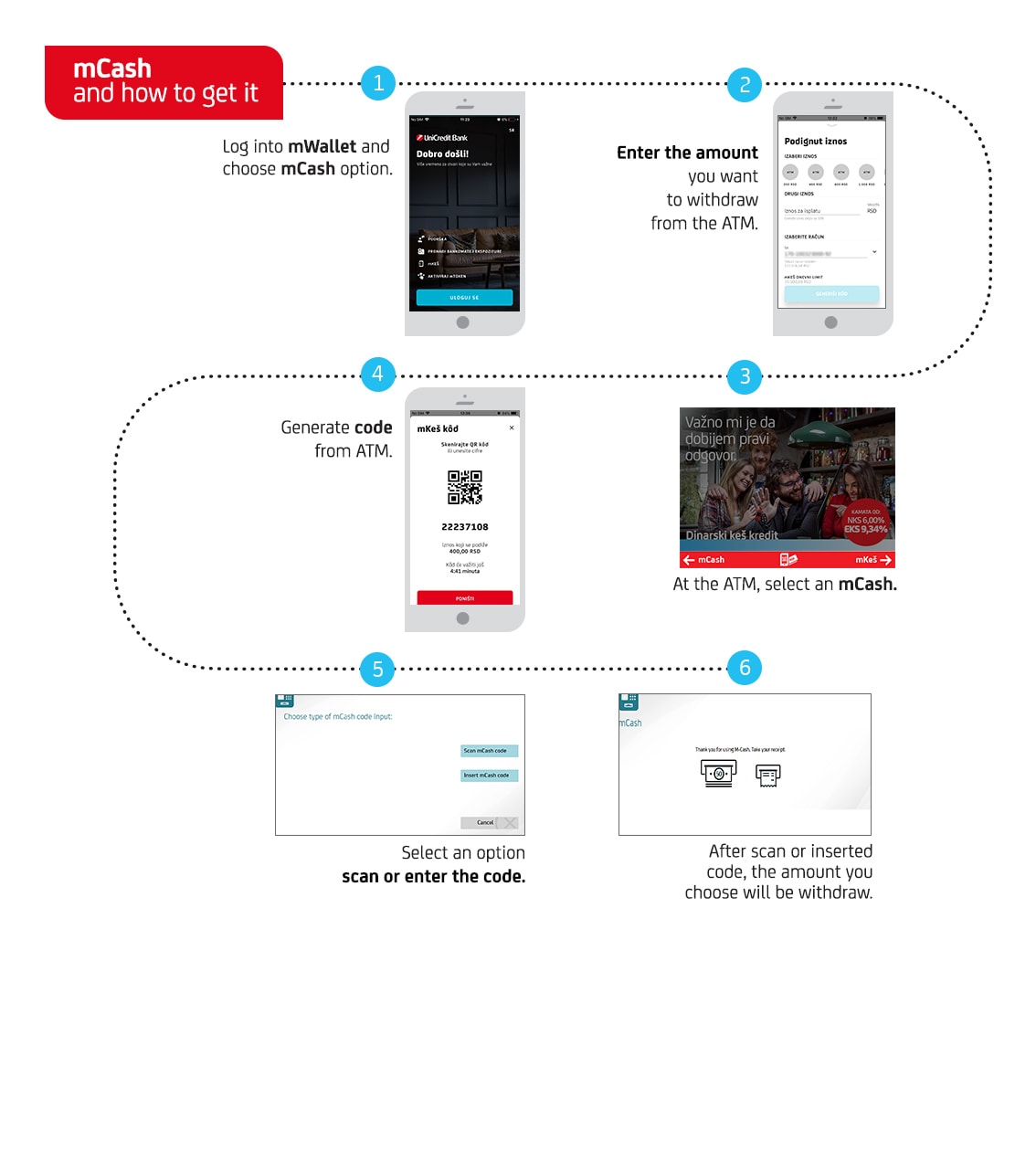

Do you enjoy the day spent in the coziness of your home, because you have decided to dedicate one day to yourself? And then remember that you need to go to the bank to pay your phone bill... Just relax and don’t worry, because current and savings accounts, credit cards, overdraft, loans and notifications are now available in your Expert mBanking application!

Financial support

Your financial advisor, as well as our application, are available whenever you need them! You knew that, didn’t you? But now thanks to chat, our support and help are available to you at any time, regardless of the bank's working hours.